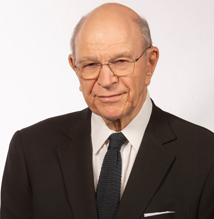

Bob Haddad has been practicing law since 1982. He attended the University of Louisville on a baseball scholarship and received his undergraduate degree in 1978. After playing a year of professional baseball, he entered the University of South Carolina Law School. He graduated from the University of South Carolina and did a clerkship with a Federal Judge in Norfolk, Virginia for one year. Obtaining a clerkship position with a Federal Judge is not only valuable as further education prior to beginning your legal career, but it is an extremely competitive position. Each Federal Judge is only allowed to hire two clerks per year. Only a select group of law school graduates are in a position to fill those clerkship slots every year.

After working in Federal Court for a year, he began his career with a local law firm in the Virginia Beach area. Three years later, he, along with several other attorneys from that firm, began the firm of Ruloff, Haddad, & Woodward. He has spent his career representing folks who have been injured either through automobile accidents, medical malpractice, or by some defective product. He, along with his partner, Doug Hornsby, were the attorneys in a medical malpractice case which resulted in the largest medical malpractice wrongful death verdict ever rendered by a jury in Virginia.

Mr. Haddad is married and the father of six children. He is active in the community in working with various children’s organizations, including coaching and participating in numerous school activities.

Mr. Haddad is the past President of the local chapter of the Federal Bar Association, and he was the lead attorney in the seminal Supreme Court case on common law punitive damages in drunk driving cases in Virginia, Huffman v. Love, 245 Va. 311 (1993). He was also the attorney in the Supreme Court case of Barkley v. Wallace, 267 Va. 369 (2004) that significantly broadened the right of injured persons to have their medical bills admitted into evidence in their personal injury suit, even though they had been previously discharged in bankruptcy.